Understanding Credit Scores: Explaining What They Are, Why They Matter, and How to Improve Your Credit Score

Your credit score is a three-digit number that wields incredible power in your financial life. It affects your ability to secure loans, credit cards, favorable interest rates, and even rental agreements. Yet, despite its significance, many people have limited knowledge of what a credit score is and how it works. In this article, we'll demystify credit scores, explore their importance, and provide tips on how to improve your credit score.

What Is a Credit Score?

A credit score is a numerical representation of your creditworthiness. It's a tool that lenders, landlords, and even employers use to assess the risk associated with extending credit or opportunities to you. The most commonly used credit score in the United States is the FICO score, which can range from 300 to 850. A higher score generally indicates better creditworthiness.

Why Do Credit Scores Matter?

Credit scores matter for several reasons:

Loan Approval: Lenders use credit scores to determine whether to approve your loan applications. A higher score improves your chances of approval.

Interest Rates: Your credit score influences the interest rates you're offered. A better score can secure lower interest rates, saving you money over time.

Credit Cards: Credit card issuers use your credit score to set your credit limit and determine your card's terms and conditions.

Rental Agreements: Landlords often check credit scores to assess the risk of renting to you. A low score may result in higher security deposits or rejected applications.

Insurance Premiums: Some insurance companies use credit scores to determine auto and home insurance premiums.

Employment Opportunities: In some cases, employers may review credit reports as part of their hiring process, especially for positions involving financial responsibility.

What Factors Affect Your Credit Score?

Your credit score is influenced by several factors, with the most important being:

Payment History: Your track record of making on-time payments, including credit card bills, loans, and other debts.

Credit Utilization: The ratio of your credit card balances to your credit limits. Lower utilization rates are generally better for your score.

Length of Credit History: How long your credit accounts have been open. Longer histories are typically more favorable.

Credit Mix: The diversity of credit accounts you have, including credit cards, installment loans, and mortgages.

New Credit Inquiries: The number of times you've recently applied for new credit. Multiple inquiries in a short period can negatively impact your score.

Public Records: Negative information such as bankruptcies, liens, and collections can significantly lower your score.

How to Improve Your Credit Score

If your credit score needs improvement, here are steps you can take to boost it:

Pay Bills on Time: Consistently pay your bills by their due dates to maintain a positive payment history.

Reduce Credit Card Balances: Lower your credit card balances to decrease your credit utilization ratio.

Keep Old Accounts Open: Keep older credit accounts open to maintain a longer credit history.

Diversify Your Credit Mix: If you have only credit cards, consider adding an installment loan or mortgage to diversify your credit mix.

Limit New Credit Applications: Be selective with new credit applications to avoid multiple hard inquiries.

Check Your Credit Report: Regularly review your credit report for errors and discrepancies. Dispute any inaccuracies you find.

Set Up Payment Reminders: Use automated payment reminders to ensure you never miss a due date.

Negotiate with Creditors: If you're struggling with payments, communicate with your creditors to negotiate manageable terms.

Conclusion

Understanding your credit score is essential for making informed financial decisions and securing favorable credit terms. By recognizing the factors that influence your score and taking steps to improve it, you can enhance your financial health and open doors to more opportunities in your financial journey. Remember that building good credit is a gradual process, so be patient and persistent in your efforts to achieve a better credit score.

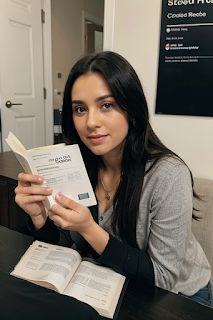

Here are some recommended books that can help you understand credit scores, credit management, and how to improve your credit:

"Your Credit Score: How to Improve the 3-Digit Number That Shapes Your Financial Future" by Liz Weston: This book offers a comprehensive guide to understanding your credit score and provides practical tips for improving it.

"The Complete Idiot's Guide to Understanding Your Credit" by Lita Epstein and Alpha: A user-friendly guide that explains credit scores, credit reports, and how to manage and improve your credit.

"Credit Repair Kit For Dummies" by Steve Bucci: This book provides step-by-step guidance on repairing and improving your credit, including tips on dealing with creditors and credit bureaus.

"Credit Scores and Credit Reports: How The System Really Works, What You Can Do" by Evan Hendricks: This book delves into the inner workings of the credit scoring system and offers advice on improving your credit profile.

"The Credit Repair Answer Book: Understand Your Credit, Improve Your Credit, and Live Your Financial Dreams" by Gudrun M. Nickel: This book answers common questions about credit scores and provides strategies for credit improvement.

"Perfect Credit: 7 Steps to a Great Credit Rating" by Lynnette Khalfani-Cox: The author shares practical advice on raising your credit score, reducing debt, and improving your financial health.

"Credit Scoring 101: Understanding the Basics of How Your Credit Score Works" by Robert B. Brown: This book simplifies credit scoring concepts and helps readers understand the factors that influence their credit scores.

"The Smart Consumer's Guide to Good Credit: How to Earn Good Credit in a Bad Economy" by John Ulzheimer: This guide provides actionable tips for maintaining and improving your credit in challenging economic times.

"How to Repair Your Credit Score Now: Simple No Cost Methods You Can Put to Use Today" by Jamaine Burrell: A practical book that offers straightforward advice for repairing and rebuilding your credit.

"The Debt Escape Plan: How to Free Yourself from Credit Card Balances, Boost Your Credit Score, and Live Debt-Free" by Beverly Harzog: This book focuses on escaping debt and improving your credit score through specific strategies.

These books cover a range of topics related to credit scores, credit reports, and credit management, offering insights and guidance to help you better understand and manage your credit.

#financial growth #bank #online bank #save money #money #cryptocurrency #financial #finances #red pill #exchange #financial health #coin #bitcoin #ethereum #dogecoin #Tether USDt #bnb #Dogecoin #credit score #credit card

Comentários

Postar um comentário